Learning Corporate Learning 🏢 Newsletter #70

A deep-dive into the corporate learning-edtech market for startups

Hi there! Alberto here, joining from Madrid this week.

The Transcend Newsletter explores the intersection of the future of education and the future work, and the founders building it around the world.

We welcome 177 new readers to the newsletter since our last post. If you love reading about the future of education and work, hit the ❤️ button and share it with your friends!

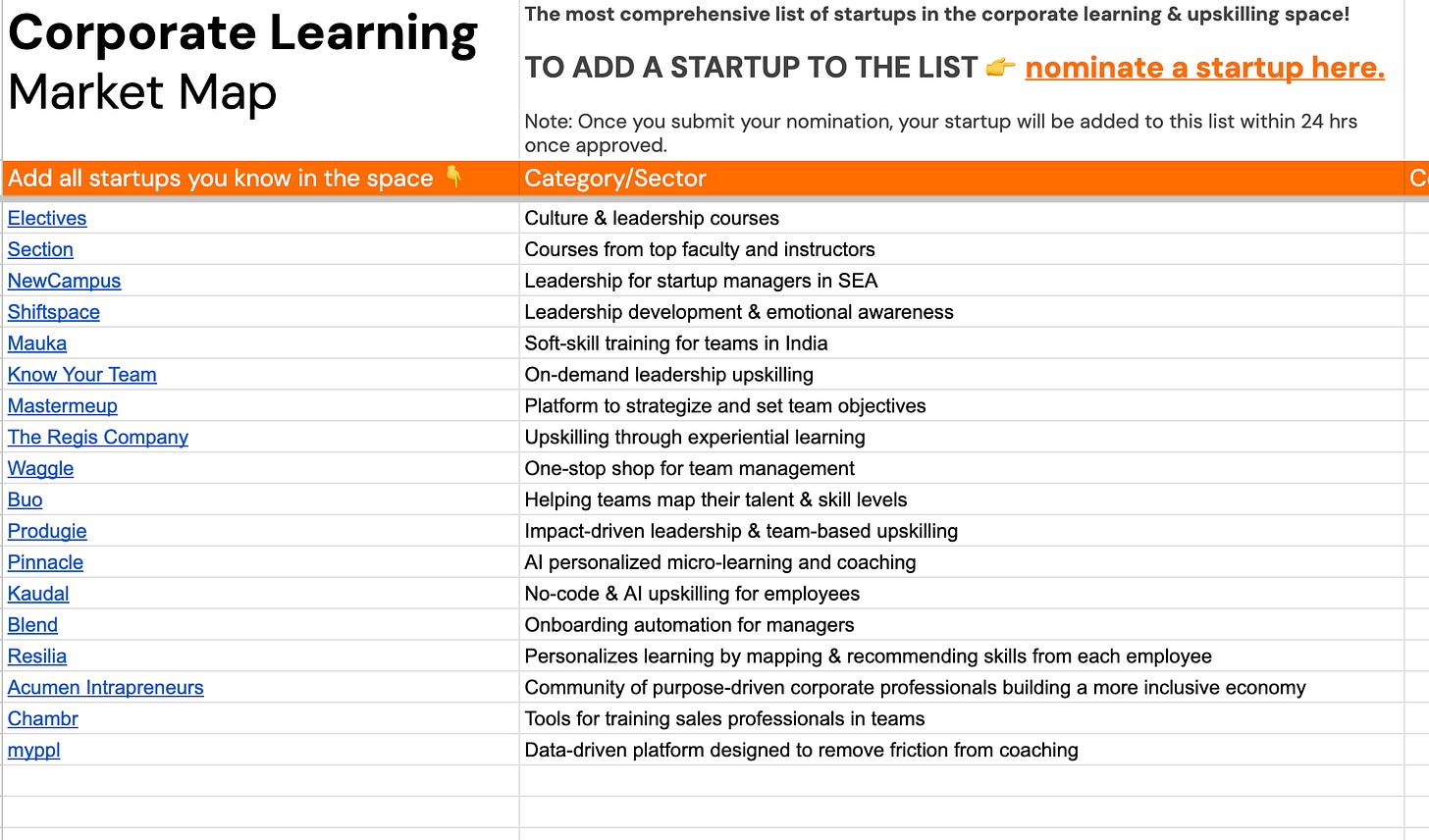

In this newsletter, we cover the state and future of Corporate Learning startups in Edtech – simultaneously, we are using this opportunity to build the most comprehensive market map of corporate learning startups! If you or someone you know are in the early stages of serving corporates, make sure to add yourselves here. More on this towards the end of this newsletter. Now let’s dive in!

Anyone who’s built a startup in the space knows there is a big gap between the theory and the practice of corporate learning.

The theory tells us it’s a goldmine ready for disruption: it’s a $300B+ market, highly fragmented, with products that are so ready to disrupt that they hurt to look at sometimes.

The practice, however, says that corporate learning is a tough market to build a startup in. Really tough.

In today’s piece, we are going to break down the corporate learning space and how early-stage founders can navigate the challenges and opportunities in the space. We are excited by the new trends that are shaking up the industry, and we hope you join us in our excitement!

How big is corporate learning?

Corporate learning is all the learning that happens through employers, not educational institutions or the individual’s own learning. And it’s a big market: it’s reported to exceed $357.7B globally, making it one of the larger markets in the education and future of work space.

But there’s a catch.

Corporate learning, just like many other education sectors, suffers from the “TAM Fallacy”: thinking that the raw Total Addressable Market (TAM) is a predictor of actual market opportunity for startups.

In reality, 64% of that TAM is spent internal budget (payroll for teams that manage corporate learning, create content and internal trainings), which immediately shrinks the market for startups as external vendors to 36% of the total budget (still a healthy $100B of a market!).

It’s important that founders understand this – in reality, it means that there are only some budgets they can tap into as an external provider, and we’ll help you navigate these below.

Corporate Learning 101

Corporate learning is an amalgamation of different departments, budgets and strategies, all stitched together under one term: the simplest way to break it down is by the company budget it involves at the company (see the visual below for more).

First, there’s a necessary layer of HR infrastructure that captures the team and employee data, with HRIS like Workday, SAP and many others. These are large and very established players in the market. Good luck trying to disrupt them 😅.

Secondly, there’s another infrastructure layer that aggregates all the employee learning data, and integrates with other employee-facing tools: the Learning Management Systems (LMSs, like Moodle, Anthology, Cornerstone), Learning Experience Platforms (LXPs, like Degreed or Edcast) or employee skills platforms (Workera, Buo).

On top of the learning infrastructure, we find 3 distinct budgets:

Benefits: learning perks for employees, such as using tuition reimbursement benefits to enroll in university, like Guild, or buying any learning resource they want through Sunlight or Perkbox

Compliance: mandatory training in topics like workplace safety, anti-harrassment or regulatory training. Go1 is a market leader here.

Learning & Development: this is the largest category, and usually has its own department (L&D, whereas compliance and benefits are run by HR). The main categories are Management and Leadership Trainings, which have larger budgets per employee and focus on a few key skills (like Franklin Covey, Hone, ExecOnline), and the offerings for all employees (which are more content-based and more scalable).

Lastly, we look at four product categories within L&D:

Content: libraries of learning content covering a wide range of topics (Coursera & Udemy for Business, Pluralsight, Skillsoft). Live classes are increasingly a part of this category, like Electives, Section or NewCampus.

Upskilling: programs focused on learning new skills (upskilling) or relocation of talent within the company (reskilling), both being more intensive than just content (Multiverse, Guild).

Coaching: support from coaches, mentors or even peers for employees’ learning (BetterUp, CoachHub, Torch).

Simulations: a new wave of scalable learning experiences that creates practice scenarios for employees (Strivr, SimSkills)

A new era of Corporate Learning is brewing ☕️

Continuing the trends through the pandemic, much of the in-person trainings and services have moved towards digital and subscription models.

Even as employees have come back to the office, this has still remained in place for the most part!

The L&D budgets stayed strong through the last years, but 2023 is a year of uncertainty. Anecdotally, many startups share that the budgets have been much harder to tap into, and companies have dropped the non-essential costs.

However at the macro level, it looks like funding cuts are still limited, with just 16% of L&D budgets receiving cuts in the last six months. This data will likely get more accurate (and likely pessimistic) as the year goes on.

Still, the corporate learning market is seeing fresh perspectives and products from early-stage startups disrupting how employees learn. Here are some of the trends we are seeing:

#1 🏋️♀️ From Bite-sized, to Personalized

Engagement is the enemy of any L&D leader. 5-10% completion rates among courses and trainings are the norm.

Over the last years, there’s been a push to create shorter and shorter “micro content” that addresses this, while fitting the needs of employees’ learning constraints.

Many startups today are defending it’s shorter lengths, but more relevant learning, that drives engagement. Sure, employees only have 20 minutes per week to learn, but they spend hours listening to podcasts and documentaries they find interesting! The new wave of content creators aren’t about building bite-sized at all costs, but about making the content more relevant and personalized. Startups like Electives, Section, Hone, NewCampus, Shiftspace, Know Your Team or Mastermeup are creating content that’s updated for today’s work and brings new instructors and formats.

#2 🏎️ From Presentations, to Simulations

Historically, L&D leaders had to make a decision between active, live trainings (expensive but effective) or self-paced courses (cheap and scalable to all employees, but largely ineffective). A middle way is emerging: simulations!

Simulations take the structure and scalability of courses, but involve the employee in active learning, through real-life scenarios and experiences that will train them for future experiences. It’s still an emerging category, but players like SanaLabs, Simskills, or WarpVR, Mursion (VR simulations) are growing here.

#3 📲 From the laptop, to your phone

Another way to address the engagement gap is to change the medium, not the content.

New startups are adapting learning experiences for communication channels employees are using everyday, such as WhatsApp, SMS (Arist) or Slack (Pinnacle). This is particularly important for large employers with large frontline worker bases (Chatclass, Anthill or Blend are growing in this space).

#4📍 From to management courses, to management coaches

The emergence of LLMs brought the idea of “AI coaches or copilots” for learning.

We are increasingly seeing such coaches for managers that take in all the unstructured data from their busy schedules, and turn them into nudges, advice and reminders. Waggle is largely focused on manager nudges, while Bunch is focused on daily tips and Q&A!

These are some of the areas we are seeing good traction, but the opportunities abound in corporate learning, considering that <15% of organizations reach all managers with their leadership training, or that only 12% of employees apply new skills learned in L&D programs to their jobs.

We need more and more innovation in the space – tell us about more in our market map below!

5 pieces of advice to new founders

The founders we spoke with that some hot takes to share with future founders, and with your younger selves. Here are the main areas of advice:

1. “Users ≠ Buyers”

The most common mistake early-stage founders make is building a product that is only loved by the user (employees), but not the buyer (L&D managers or directors).

The overwhelming advice from founders is to focus your early customer discovery and testing on the buyers, because that’s the only way to make the business sustainable.

Secondly, building strong buyer relationships is key to scale, as this is a highly relational space. One founder phrased it this way:

“It's not just about building a superior solution; it's about cultivating stronger and more enduring relationships over time that can compete with the established players in the field.”

2. “Build for a sample size of 1”

Getting your first customers is the hardest milestone in corporate learning.

Most of the founders we interviewed got them through existing relationships, but many others found smart ways to reach them: through conferences, building an early advisor network with industry connections, building in public, etc.

Most founders would have spent more time understanding what was actually important to those first customers, because they are accustomed to services and content > technology tools, and that requires some adaptation. From another L&D founder:

“The space is still driven a lot by selling consulting and content, not tech solutions. Buyers tend to hire a training provider for a project and content scope and are not easily prepared to add another SaaS solution on top of preexisting legacy LMS”.

3. “VC isn’t always right”

Some of the largest companies in edtech are in the corporate learning market, like Anthology, D2L, Docebo, Cornerstone, Skillsoft or Franklin Covey.

But look at what year each of those companies was founded in: none of them would fit within one VC fund lifecycle of ten years, as they grew over many decades. Many startups are finding new pathways to funding that are alternatives to VC, which also increase the founder agency and optionality.

“Instead of raising venture capital early on, I would have focused on understanding the unit economics of our business in the lucrative corporate training sector, where healthy margins are the norm. Relying on venture capital can lead to a disproportionate emphasis on rapid growth, which can be challenging during investment droughts or economic downturns.”

4. ROI is your “Why”

ROI (or Return on Investment) for the customer is your “Why” as a founder, because it’s how you measure success of your product!

L&D teams have very different ways of measuring it (some don’t measure it at all), and this is one area where founders should be proactive about measuring ROI internally to aid the sales process:

“ROI is notoriously hard to prove in this space, but also many buyers don't have outcome-oriented success metrics and incentives”

One tip from a founder: instead of simply selling the product, take the time to ask the customer directly how they measure ROI within their team, so you know what to focus on as you build the product. You can then find ways to measure how the users are doing through assessments or surveys, and build reports that communicate that progress.

After doing this exercise, many startups actually shift away from L&D and into other budgets who value the impact to the users, like HR (products that increase employee retention, like Guild) or business budgets (Chambr went from serving L&D to serving sales teams).

5. “Internal corporate learning is unbundling”

As we saw in the “TAM Fallacy”, 65% of the corporate learning market is spent internally.

A founder we interviewed said this is changing: as budgets get leaner, companies will reduce their L&D teams, and look to externalize functions to startups that were previously done by teams.

Onboarding team members and making sure they are up to date will always be an internal function. But everything else, like content design and creation, leadership training, management training, assessment, etc. will be available for external vendors.

In-house trainers cannot teach everything a company needs, and employees want to learn from experts – this will be fertile ground for new specialist startups!

Are you building in Corporate Learning?

We are building the most comprehensive market map of corporate learning startups and wish to connect with those who are in the early stages of building in this space.

If you or someone you know is building a startup in the space, add their name to our market map. Our team will review your startup, and once approved, add it to this ongoing list within 24 hrs.

Big big thank you to the founders who helped us put together this piece! Thank you to Jason (Electives), Will Houghteling (Strive/Franklin Covey), Sarah (Waggle), Will Fan (NewCampus), Kirill (Shiftspace), Jan (Chatclass), Anthony (Bunch), Alexei (Pinnacle), and all the other founders and L&D leaders that contributed anonymously.

The Roundup ☀️

Meet the latest cohort of Transcend Fellows (TF12)! Cohort announcement here.

Ali Buckland (TF10) and team Skizaa won the coveted $25,000 Cognativ Inc prize as finalists at the Milken Penn GSE Education Business Plan Competition! Read more here.

Adeel Khan (TF11) and MagicSchool.ai raises $2.4M to tackle teacher burnout with artificial intelligence. Read more here.

Thank you for reading!

Did you enjoy reading this piece?

Hit the ❤️ button to help us reach more awesome people like you!

I appreciate this write-up and the effort to build a "market map."

The trends in the corporate L&D space all track with what I've observed as a buyer and a provider.

The tips for entrepreneurs are also shrewd and should be taken seriously. Another option for operators is to look seriously and deep partnership and engaging in M&A. A lot of similar solutions approached by bootstrapped teams could be better delivered with the best ideas and teams brought together under one roof.

When the list is done, do you have plans to visualize it? Showing companies organized by sub-category (like the diagram you provided) and maybe also represented by size of revenue, customers, employees, or some other scale metrics could be valuable. Looks like that's what you've done with other sectors. 👏

To your point above, a lot of successful incumbent companies are well past the "startup" phase. It seems like the mapping exercise really is aiming to show the whole industry - and thus your spreadsheet could be renamed to be list of all "companies."

Last thing I'd add - startups need to not just think about buyers as the L&D admins but also the functional and corporate leaders across the business. Their buy-in is essential, as the success of a deployment is not only sometimes dependent on their budgetary support but also on their active sponsorship and modeling to employees of engaging with the solution.

Good post as always Alberto. I have been thinking that US$1-2Mn acquisitions might be important in various segments you mention as a growth strategy for entrepreneurs. There might be PMF to some extent, some revenue traction and some key hires with the relevant connections. Companies might look at acquiring in the US or acquiring something in Europe that also has in-roads in the US.

Akhil Kishore

GIA ADVISORS