2023 Predictions for Edtech 🔮Newsletter #61

7 Predictions on what the future of learning holds this year

Hi there! Alberto here, joining from Madrid this week. Excited to jam with my cofounder Michael today for the very first newsletter of the year!

The Transcend Newsletter explores the intersection of the future of education and the future work, and the founders building it around the world.

We welcome 544 new readers to the newsletter since our last post. If you love reading about the future of education and work, hit the ❤️ button and share it with your friends!

Humans suck at predictions. They make us look smart, but there’s little evidence to show that pundits and visionaries have anything but luck.

Here’s the thing: every startup is a fundamental bet on one potential future. Founders bet their savings, the most productive years in life, and their sanity on these predictions, and they can help us stay grounded in reality.

Making predictions has been very useful for us at Transcend, because they push us to think about the world in deeper ways.

So here they are: seven predictions for the state of education and work in 2023. They are the result of discussions Michael and I (cofounders of Transcend) have had in the last few weeks, and each has a clear metric we can use to re-evaluate the prediction in a year.

This coming Thursday, January 26, Michael and I will be on a Twitter Spaces diving deeper into these predictions, and we hope we can jam with you too!

#1: Startup M&A is back 🤝

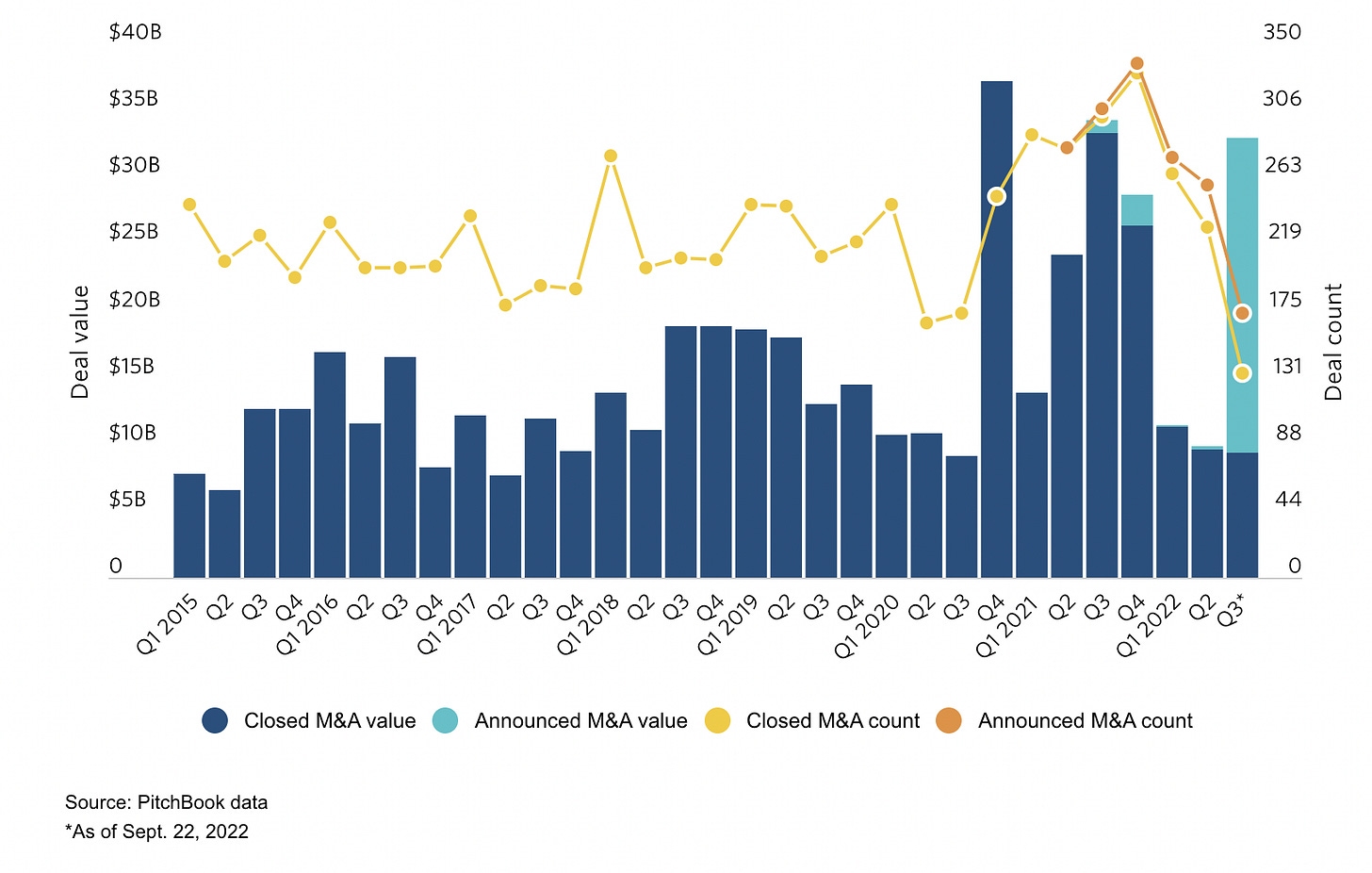

We are in the middle of a tough fundraising and business market, which is making a lot of startups suffer from drying runways. Mergers and acquisitions of startups (M&A) decreased last year, but I expect M&A activity to jump in 2023.

Acquisitions are particularly valuable in edtech, where distribution is king. Larger incumbents tend to acquire younger startups to upgrade their legacy products, and this is particularly acute in some enterprise sectors like corporate learning, higher ed or K-12.

In my view, India is a few years ahead of the rest of the world. VC funding for edtech started drying up earlier in India (around 2021) after a COVID-fueled edtech boom, and market consolidation has already started there. We are seeing seed/Series A-stage startups doing acquisitions already to consolidate their markets, like BoardInifinity, which is quite early in startupland.

There are two types of deals we are seeing accelerate right now:

acquihires, where the buying company acquires a startup at a very steep discount in order to integrate the team into the acquiring structure. More and more founders are exploring this, given their runway is shorter and can’t find PMF.

buyouts, where successful growth-stage startups decide to sell to a private equity (PE) firm now, instead of waiting another 5 years to try and go public. Buyouts are an increasingly popular strategy for education startups, as the IPO path dries up.

Prediction and metric to track: Will 2023 M&A deals surpass that of 2022, according to Pitchbook data?

#2: We’ll see 70+ US college closures this year 🏫

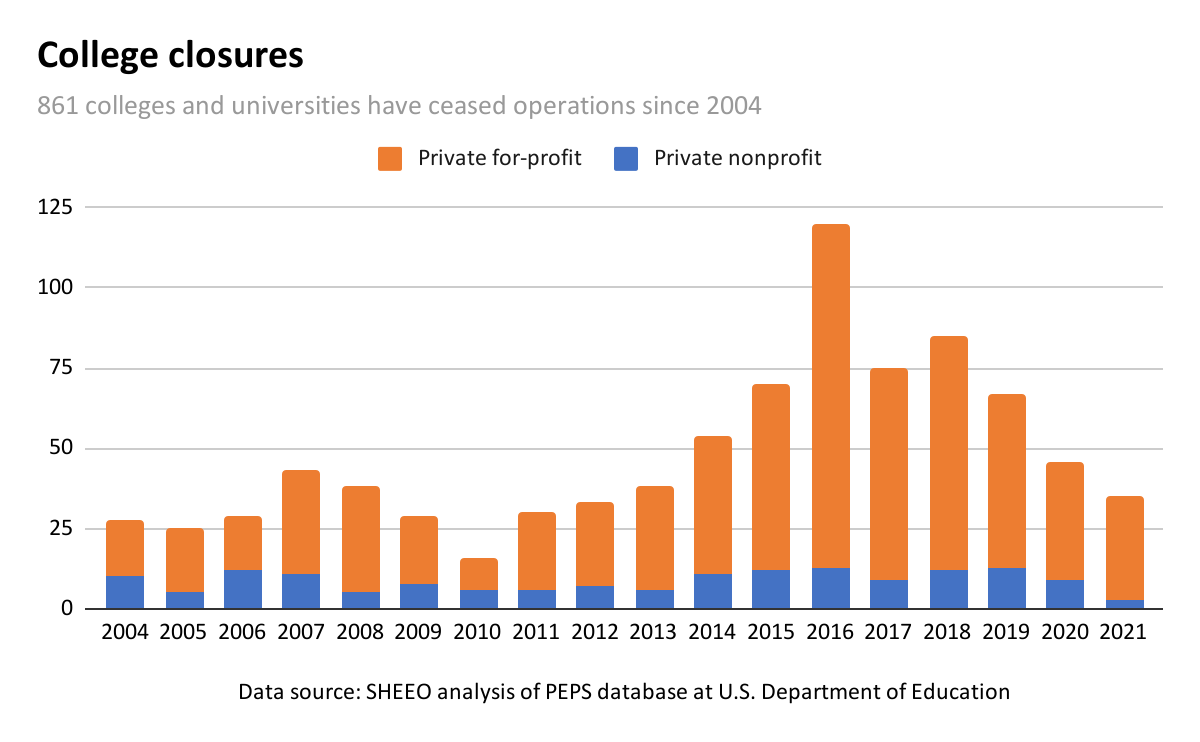

In 2021, Fitch counted 35 colleges and universities that closed. This may seem alarming to many, but it’s actually the lower number on record in over a decade: just five years ago, that number was as high as 100+ closures per yera.

In the Great University Reset, we argued that, while universities have historically worked best during economic recessions (as people look to upskill in challenging labor markets), we think this trend will revert and traditional college closures will increase.

This is because learners will prefer educational programs that lead to jobs more directly, like bootcamps, apprenticeships or professional certificates, as they are built for that purpose. Learners don’t want to enroll in lengthy four-year degrees to get the job done if they can do it in 6-12 months, and in a way that best fits their needs (part-time, online, focusing on high-demand skills only).

The wealth of new programs (often called last-mile training) has exploded in the last decade, and even more will be created in the coming decade, which will affect enrolment numbers from universities. I predict we’ll get back to pre-covid levels and will surpass 70 closures and college mergers this year.

Prediction and metric to track: Will college closures surpass 70 in 2023, according to Hechinger Report?

#3: 2023 is the year of Boring Edtech 🛣️

COVID ignited conversations all around the world about how education could be reimagined. A lot of amazing ideas and innovations have stayed, but others were not more than a fad. Edtech isn’t so special anymore, and that may be a good thing!

Glamorous Edtech, the ideas that new entrants to education were bringing in, is giving way to a new era of more realistic, on-the-ground work. I believe we are now entering a time where Boring Edtech will dominate, the startups that solve less glamorous problems that are actually felt by students, teachers, and administrators. Education isn’t changed in fancy pitch decks and Twitter threads but in the daily grind of classrooms.

Why Boring Edtech?

Pivots to resilient customers/market A lot of the new education ideas created during COVID relied on consumers with disposable income to invest in education, but as pockets get tighter, a lot of startups are feeling the burn. Boring Edtech markets like corporate learning, k-12, and higher ed, will prevail over more fragile emerging budgets.

Buyers > Users: This change will come from founders, who will pivot to serve customers that are consistently great buyers. This will push founders to better understand the needs of the buyer in markets with both users and buyers, like K-12, and will likely mean there’s market consolidation.

This is not a panacea for founders, of course. Boring Edtech means long sales cycles for startups (one of our fellows has to wait 6+ months to get a meeting with a potential higher ed customer), and lots of intermediaries (school admins, HR or L&D) could be prioritized over end users. But it’ll ground edtech innovations on real demand from customers, which is a good thing.

Prediction and metric to track: Will founders from “boring edtech” markets (B2B K-12 + Higher Ed + Corporate learning + HR) increase by 20%+ from 2022, according to our own internal database (from all applicants + tracked startups)?

#4: Edtech funding will be the same as 2022 💰

Edtech funding was down 50% in the last year, adding up to $10b in funding globally. Markets like China totally disappeared from the map, while the US saw a massive dip in funding.

The most affected startups were late-stage ones, as fewer megarounds were put together and very few new unicorns were minted in 2022. The usual suspects here were generalist funds who would join large funding rounds from 2020 to 2022, like BYJUs, Yuanfudao or GoStudent. Those rounds are mostly gone and are not expected anytime soon, but the rest of the edtech investing ecosystem should stay more robust.

Next year isn’t getting any easier, but I actually expect edtech funding to stay equivalent to 2022.

In our 2023 State of Edtech Investing, 35% of investors expected to invest more this year than in 2022, with only 18% predicting they’ll invest less than last year (the rest expect to invest roughly the same). Why is that?

Capital preservation last year: Anecdotally, edtech investors were very cautious last year, and they have plenty of “dry powder” (uninvested capital, which is at an all-time high this year) they need to invest to fit their fund timeline. Given how funds work (they only have a few years to invest their funds), I see many of the funds that were raised in the last years have preserved capital, and will invest a lot of that in 2023.

Edtech during recessions: edtech is a relatively healthy market during recessions, as governments heavily invest (and often subsidize) educational programs and individuals see education as an economic mobility tool. This makes the investments in the next 3 years attractive as a financial opportunity.

Without predicting what may happen beyond 2023 (that’s a different story), our prediction is that edtech funding won’t decrease significantly from last year.

Prediction and metric to track: Will edtech funding in 2023 stay roughly the same (within 10%) of 2022’s total funding, according to HolonIQ’s data?

#5: We’ll see a rise in AI “Copilot” tools 🤖

GitHub’s Copilot is an AI-enabled feature that suggests code and functions to developers as they code away in their computers, and it made them happier and more productive at work!

Imagine having a “copilot” like this one supporting you as you make decisions in your day to day work. With the rise of generative AI, we expect a rise in “Copilot for X” startups that help professionals and creatives with other tasks and work, like writing, painting, music making/editing, etc. Importantly, these are substituting, but complementing individuals.

As someone who uses ChatGPT daily, count me in as a beta tester for copilot startups!

Prediction and metric to track: Will founders building “copilot for X” startups increase by 20%+ from 2023, according to our own internal database (from all applicants + tracked startups)?

#6: Layoffs will unlock a new wave of entrepreneurial talent 🚀

Recessions are a tough time to launch a business, and it looks like we are entering one for the next few years.

But we think there’s a more nuanced to look at this trend in the education and work spaces: layoffs will lead a wave of experienced professionals to wonder what their next professional step is. If the labor market freezes up, they won’t see as many enticing employment opportunities, so they’ll build organizations that tap into their experience.

We are not thinking of VC-backed entrepreneurs raising and hiring at full-speed, but 5-6 figure-per-year businesses built by bootstrapping founders. Building these types of businesses is more accessible than ever, from high-skill manual labor (roof cleaning, painting) to services (learning and training, virtual event production) or last mile training for high-demand skills (Hubspot or Salesforce certificates).

These bootstrapped business don’t need high upfront investments or sophisticated technologies, and we see it as a great fit for startups in the space like coding bootcamps or training providers.

Prediction and metric to track: Will founders building bootstrapped business increase by 20%+ from 2022, according to our own internal database (from all applicants + tracked startups)?

#7: The year we rethink exams 📝

2022 brought explosive growth and interest in AI tools. Many were excited initially, but other sectors of education moved quickly to ban its use, like NYC’s ban of ChatGPT. The ban is coming from seeing students cheat in applications, exams and essays in ways that are not detectable by traditional academic honesty tools, like Turnitin.

If 2022 was about building the tools, 2023 will be about adapting to its use in the classroom, and the first area to get affected is assessment. With teachers and professors starting to consider the use of comparative assessment, oral exams, in-person and paper-based exams or class participation, I predict that a new wave of tools like Examind will come to market to help schools adapt to a new way of learning.

Prediction and metric to track: Will founders building in the assessment space increase by 20%+ from 2022, according to our own internal database (from all applicants + tracked startups)?

That is all from Michael and Alberto – we’d love to hear your own predictions! Do you want to learn more about these predictions and their implications on Edtech?

Join our Open Discussion next Thursday, January 26, with the co-founders of Transcend - Alberto & Michael as we do a deep dive on our predictions for 2023!

RSVP here👉 https://lu.ma/2023Predictions

The Roundup ☀️

🎉 10 Transcend Network Startups make it to the ASU-GSV Summit’s Elite 200! Read more.

🛠️ CareerKarma’s layoff underscores edtech’s new challenges. Read More

🎮 Reflections of 50 years of gaming in education. Read more.

Great post Alberto. We also feel that M&A in the smaller deal sizes will increase. Acquihires seems to work better as a model where a company has been observing declining financials for 2-3 years. Assessments at all level is a good area - completely agree.

Akhil Kishore

Partner - GIA ADVISORS